Fixed and Variable Costs

These workers are responsible for converting the raw materials into the finished goods. However, if the company doesn’t produce any units, it won’t have any variable costs for producing the mugs. Similarly, if the company produces 1,000 units, the cost will rise to $2,000. To reduce manufacturing overhead costs, focus on improving efficiency, reducing waste, negotiating better supplier contracts, and investing in technology to automate tasks. Efficient supply chain management plays a crucial role in controlling manufacturing costs. Analyze your supply chain for opportunities to consolidate suppliers, negotiate better terms, reduce lead times, and minimize transportation costs.

Example #2: Direct labor

This rate of idle capacity isn’t unusual — the average U.S. manufacturing plant normally operates at 80 to 85 percent of its production capacity. Intangible assets can have their cost value reduced through amortization. Consider ABC Corporation investing $50,000 to buy a patent that will become invalid in 5 years. An amortization expense of $10,000 will be incurred as a fixed book cost. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

Characteristics of Fixed Costs

A type of expense or cost known as fixed costs does not change whether the volume of goods or services sold increases or decreases. They are frequently referred to as overhead costs and are time-related, such as monthly rent or interest payments. As a business produces more units, they are crucial to achieving higher profit margins per unit. The fixed manufacturing overhead costs that business reports have an impact on how profitable it appears to be. For instance, a business with fixed overhead costs that are a small percentage of the price of each unit produced will appear more profitable as production levels rise. In addition, absorption costing takes into account all costs of production, such as fixed costs of operation, factory rent, and cost of utilities in the factory.

Fixed Cost Formula

The term sunk cost refers to money that has already been spent and can’t be recovered. While sunk costs may be considered fixed costs, not all fixed costs are considered sunk. For instance, a fixed cost isn’t sunk if a piece of machinery that a company purchases can be sold to someone else for the original purchase price. That’s because as the number of sales increases, so too does the variable costs it incurs. Calculating variable costs can be done by multiplying the quantity of output by the variable cost per unit of output. Direct labor refers to the wages, benefits, and payroll taxes paid to employees directly involved in the manufacturing process.

- Also referred to as fixed expenses, they are usually established by contract agreements or schedules.

- Calculating variable costs can be done by multiplying the quantity of output by the variable cost per unit of output.

- That includes labor costs (direct labor) and raw materials (direct materials).

- Quickonomics provides free access to education on economic topics to everyone around the world.

Fixed and variable costs in ecommerce (with examples)

For example, a company might buy machinery for a manufacturing assembly line that is expensed over time using depreciation. Fixed costs are commonly related to recurring expenses not directly related to production, such as rent, interest payments, insurance, depreciation, and property tax. Incorporating climate costs shows that the real cost of manufacturing these materials is much higher than current market prices. Adopting policies that reflect these costs can create incentives to develop new, climate-friendly processes and materials. On the other hand, variable costs show a linear relationship between the volume produced and total variable costs. Fixed costs are a fundamental aspect of business operations, affecting pricing strategies, financial planning, and the overall profitability of a company.

Benefit #2: Helps make informed pricing strategies to stay competitive

The lease cost, however, is divided among 500 refrigerators if it produces 500. The fixed cost of the lease is divided among more refrigerators if the company sells 1,000 refrigerators. Profit forecasting and break-even fixed manufacturing costs point calculation are essential in business. It should be kept lower in the early stages of a business because the revenue will be less. It will undoubtedly take time for a business to grow and attract customers.

Understanding the difference between these costs can help a company ensure its fiscal solvency. Manufacturing costs are influenced by various internal and external factors that can significantly impact the overall cost structure of a business. By identifying and understanding these factors, companies can make informed decisions to manage and reduce costs effectively. Determining the exact fixed cost can be an intricate task; using a comprehensive costing approach is the best way to determine a fixed cost accurately. Companies with business models characterized as having high operating leverage can profit more from each incremental dollar of revenue generated beyond the break-even point.

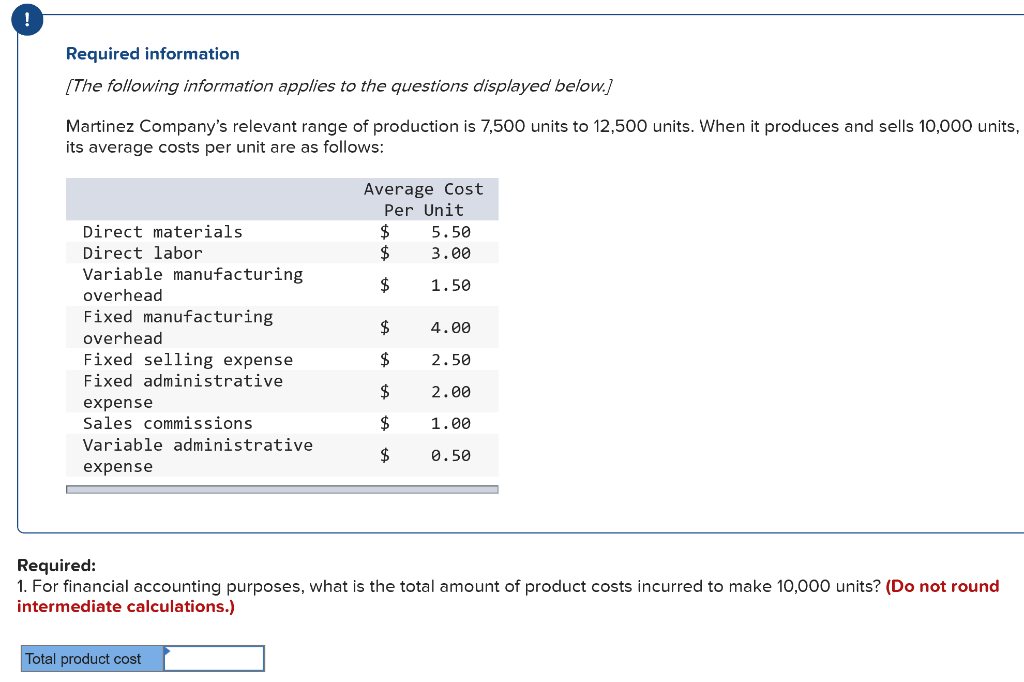

In break-even analysis, fixed costs play a critical role in determining the number of units a business must sell to cover all its costs, both fixed and variable. The break-even point is calculated by dividing the total fixed costs by the contribution margin per unit (selling price per unit minus variable cost per unit). Understanding the break-even point helps businesses set sales targets and make informed decisions about pricing, production levels, and financial planning. Manufacturing costs are the prices incurred during the manufacturing process. Manufacturing costs are made up of direct materials costs, direct labor costs and manufacturing overhead, which we’ll get to in greater detail shortly.

By effectively managing and understanding the nature of these costs, businesses can enhance their financial health and strategic positioning in competitive markets. If you’re going to compare the variable costs between two businesses, make sure you choose companies that operate in the same industry. Calculating the cost of goods manufactured helps businesses determine the total cost incurred in producing goods ready for sale, aiding in pricing decisions and financial reporting. Investing in technology and automation can streamline production processes, reduce labor costs, and minimize errors. Modern manufacturing technologies such as robotics, IoT (Internet of Things), and AI (Artificial Intelligence) can enhance productivity and efficiency. For instance, automated assembly lines can improve throughput and consistency while requiring fewer manual interventions.

The volume of sales at which the fixed costs or variable costs incurred would be equal to each other is called the indifference point. Finally, variable and fixed costs are also key ingredients to various costing methods employed by companies, including job order costing, process costing, and activity-based costing. Both of these figures are used by manufacturers to evaluate the total costs of running their business.

This is a schedule that is used to calculate the cost of producing the company’s products for a set period of time. ProjectManager is award-winning project management software that helps manufacturers plan, manage and track their manufacturing costs in real time. Our software has powerful Gantt charts to plan your manufacturing costs and secure timesheets to track labor costs all in real time. That’s on top of our features such as our automated workflows and task approval settings to streamline processes and ensure quality.